About Us

GM07 Consulting LP is a boutique consulting firm specializing in the cards and payments industry.

Founded and led by Dimitra G. Balta — a certified expert (MBA, CBAP®) with more than 18 years of international experience — the firm brings deep domain knowledge and a strong delivery mindset to every engagement.

We work alongside banks, processors, and digital payment providers, supporting complex transformation initiatives from early design to successful launch.

The firm was established by Dimitra G. Balta, a recognized Subject Matter Expert in issuing, acquiring, and ATM domains.

With over two decades of hands-on project experience across Europe and North America, GM07 Consulting LP has helped numerous institutions modernize their systems, improve operational performance, and adapt to regulatory and technological change.

Our project portfolio includes core system migrations, scheme transitions, digital banking products, and multi-country rollouts.

Our mission is to deliver strategic, results-oriented consulting across the full lifecycle of payments.

We support our clients in navigating industry complexity — from product development and system integration to compliance, certification, and go-live.

By combining business insight with structured execution, we help institutions achieve tangible outcomes and long-term value.

To become a trusted global partner for financial institutions and fintechs — recognized for delivering high-quality consulting services that shape the future of digital payments.

We aim to empower our clients to innovate with confidence, lead in their markets, and grow sustainably in a dynamic financial landscape.

Services

➤ Cards & Payments Advisory

- Product lifecycle design (issuance, activation, tokenization, reissuing)

- CMS platform migration and configuration

- Issuing/acquiring alignment and scheme compliance

➤ Business Analysis & Requirements

- AS-IS / TO-BE mapping and gap analysis

- End-to-end BRD authoring and vendor alignment

- Support for regulatory and operational readiness

➤ Delivery & Transformation Planning

- Project coordination (Agile & Hybrid)

- Go-Live readiness and cross-team orchestration

- Stakeholder communication and planning oversight

➤ Fintech Product Design

- Digital wallet & EMI application flows

- Customer onboarding, payments, and card features

- UAT support and UX/business flow validation

Our Projects

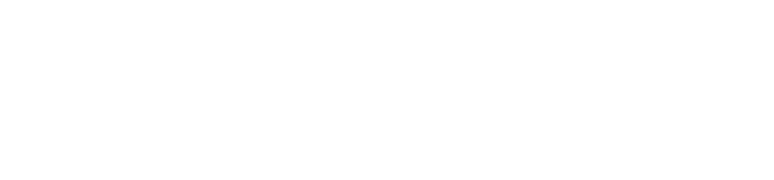

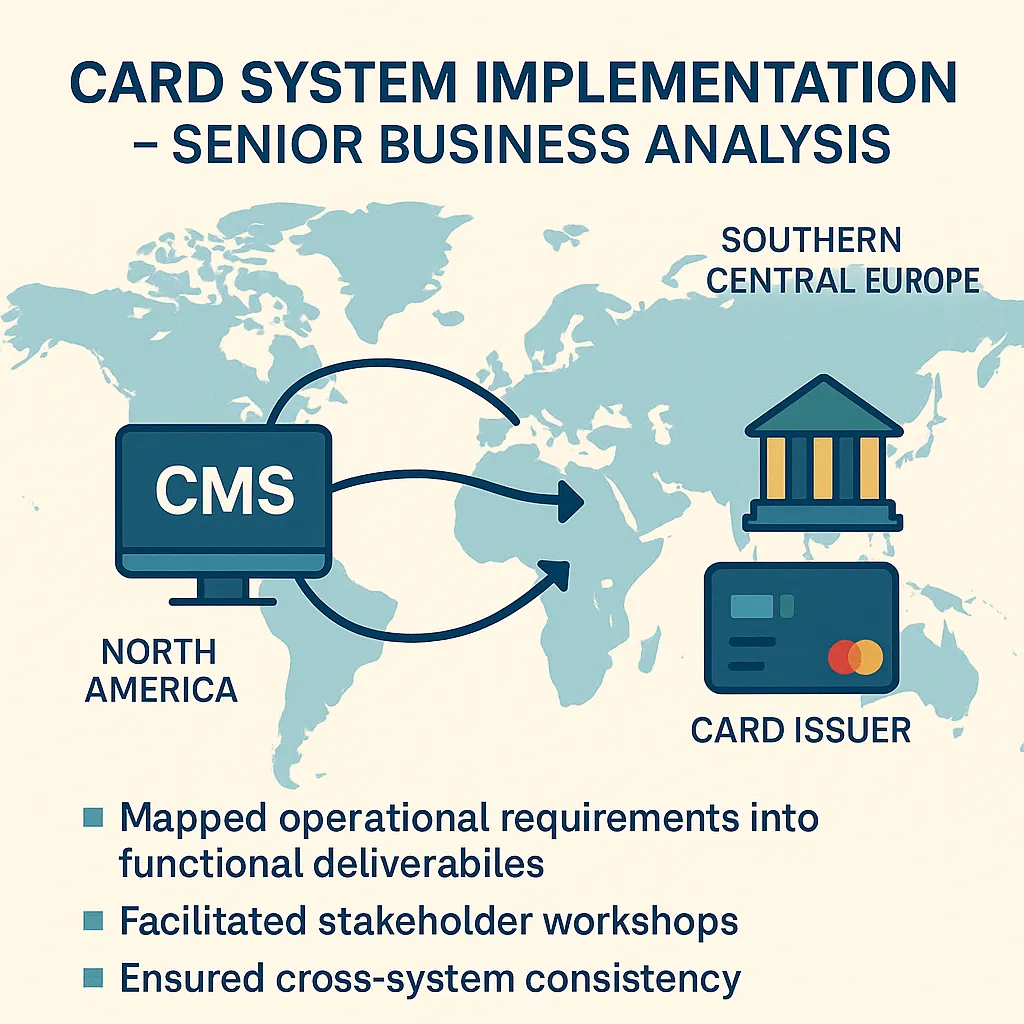

Card System Implementation – Senior Business Analysis

Directed the end-to-end business analysis process for the implementation of an advanced card issuing and acquiring platform across institutions in Southern and Central Europe and North America.

Mapped operational requirements into functional deliverables, facilitated stakeholder workshops, and ensured cross-system consistency during CMS and ATM/POS integration.

Migration of Card Portfolios Between Payment Schemes

Acted as the strategic lead for the migration of a full debit, credit, and virtual card portfolio between global payment networks.

Defined product-level transition logic, led BIN and routing updates, and managed scheme-mandated compliance across multiple service providers.

Consolidation of Card Systems Post-Merger

Supported the harmonization of card products, transaction flows, and host connections during the merger of two financial institutions.

Aligned backend CMS structures, redesigned lifecycle processes, and contributed to branding, messaging, and certification efforts across ATM and POS estates.

Digital Banking Product Ownership for Licensed EMI

Served as Product Owner for a mobile-first banking app launched by a licensed electronic money institution.

Transformed business objectives into digital features, including onboarding flows, transaction management, and card issuance, while maintaining agile delivery through user story management and sprint execution.

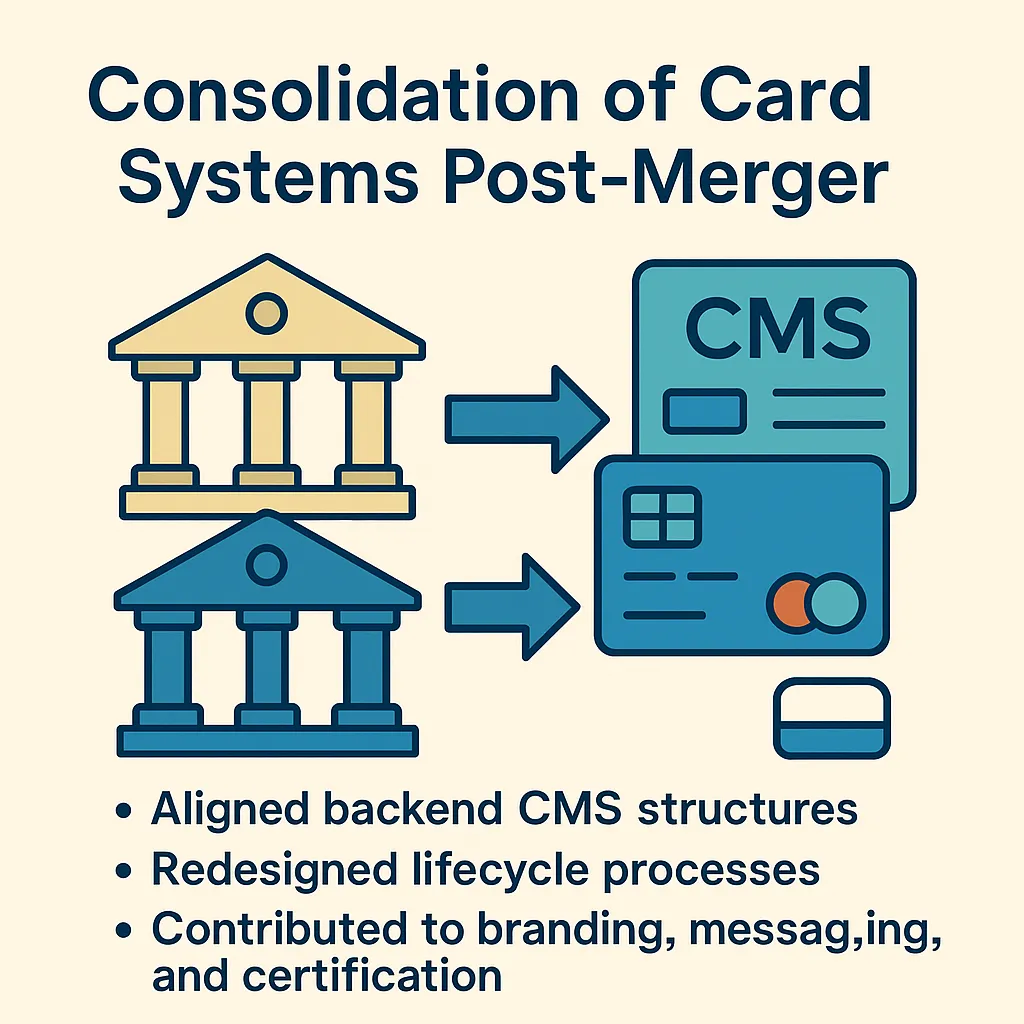

Delivery Management for Processing Platform Rollouts

Managed the delivery and rollout of multi-channel transaction services across ATM, POS, and digital touchpoints using an international processing platform.

Coordinated platform configuration, merchant setup, and clearing paths, while ensuring integration validation and SLA-based go-live support.

Certification Strategy & Quality Assurance Leadership

Led UAT preparation and execution for debit and credit card portfolios, focusing on scheme-mandated scenarios and regulatory flows.

Developed robust test plans for EMV, tokenization, and settlement validation, and worked closely with QA and compliance teams to secure certifications.

Strategic Advisory for Digital Payment Expansion

Provided advisory services for the digital payment expansion program of a retail financial institution.

Assessed platform readiness, proposed enhancements to card issuance and onboarding processes, and supported vendor alignment for ecosystem growth.

Core-to-CMS Integration for Debit & Credit Card Processing

Facilitated seamless integration between core banking platforms and a centralized CMS for real-time card processing.

Defined interface contracts, event triggers, and data flow mappings — ensuring synchronization of customer, account, and transaction data across systems.

Our Projects

Card System Implementation – Senior Business Analysis

Directed the end-to-end business analysis process for the implementation of an advanced card issuing and acquiring platform across institutions in Southern and Central Europe and North America.

Mapped operational requirements into functional deliverables, facilitated stakeholder workshops, and ensured cross-system consistency during CMS and ATM/POS integration.

Migration of Card Portfolios Between Payment Schemes

Migration of Card Portfolios Between Payment Schemes

Acted as the strategic lead for the migration of a full debit, credit, and virtual card portfolio between global payment networks.

Defined product-level transition logic, led BIN and routing updates, and managed scheme-mandated compliance across multiple service providers.

Consolidation of Card Systems Post-Merger

Consolidation of Card Systems Post-Merger

Supported the harmonization of card products, transaction flows, and host connections during the merger of two financial institutions.

Aligned backend CMS structures, redesigned lifecycle processes, and contributed to branding, messaging, and certification efforts across ATM and POS estates.

Digital Banking Product Ownership for Licensed EMI

Digital Banking Product Ownership for Licensed EMI

Served as Product Owner for a mobile-first banking app launched by a licensed electronic money institution.

Transformed business objectives into digital features, including onboarding flows, transaction management, and card issuance, while maintaining agile delivery through user story management and sprint execution.

Delivery Management for Processing Platform Rollouts

Managed the delivery and rollout of multi-channel transaction services across ATM, POS, and digital touchpoints using an international processing platform.

Coordinated platform configuration, merchant setup, and clearing paths, while ensuring integration validation and SLA-based go-live support.

Certification Strategy & Quality Assurance Leadership

Led UAT preparation and execution for debit and credit card portfolios, focusing on scheme-mandated scenarios and regulatory flows.

Developed robust test plans for EMV, tokenization, and settlement validation, and worked closely with QA and compliance teams to secure certifications.

Strategic Advisory for Digital Payment Expansion

Provided advisory services for the digital payment expansion program of a retail financial institution.

Assessed platform readiness, proposed enhancements to card issuance and onboarding processes, and supported vendor alignment for ecosystem growth.

Core-to-CMS Integration for Debit & Credit Card Processing

Facilitated seamless integration between core banking platforms and a centralized CMS for real-time card processing.

Defined interface contracts, event triggers, and data flow mappings — ensuring synchronization of customer, account, and transaction data across systems.